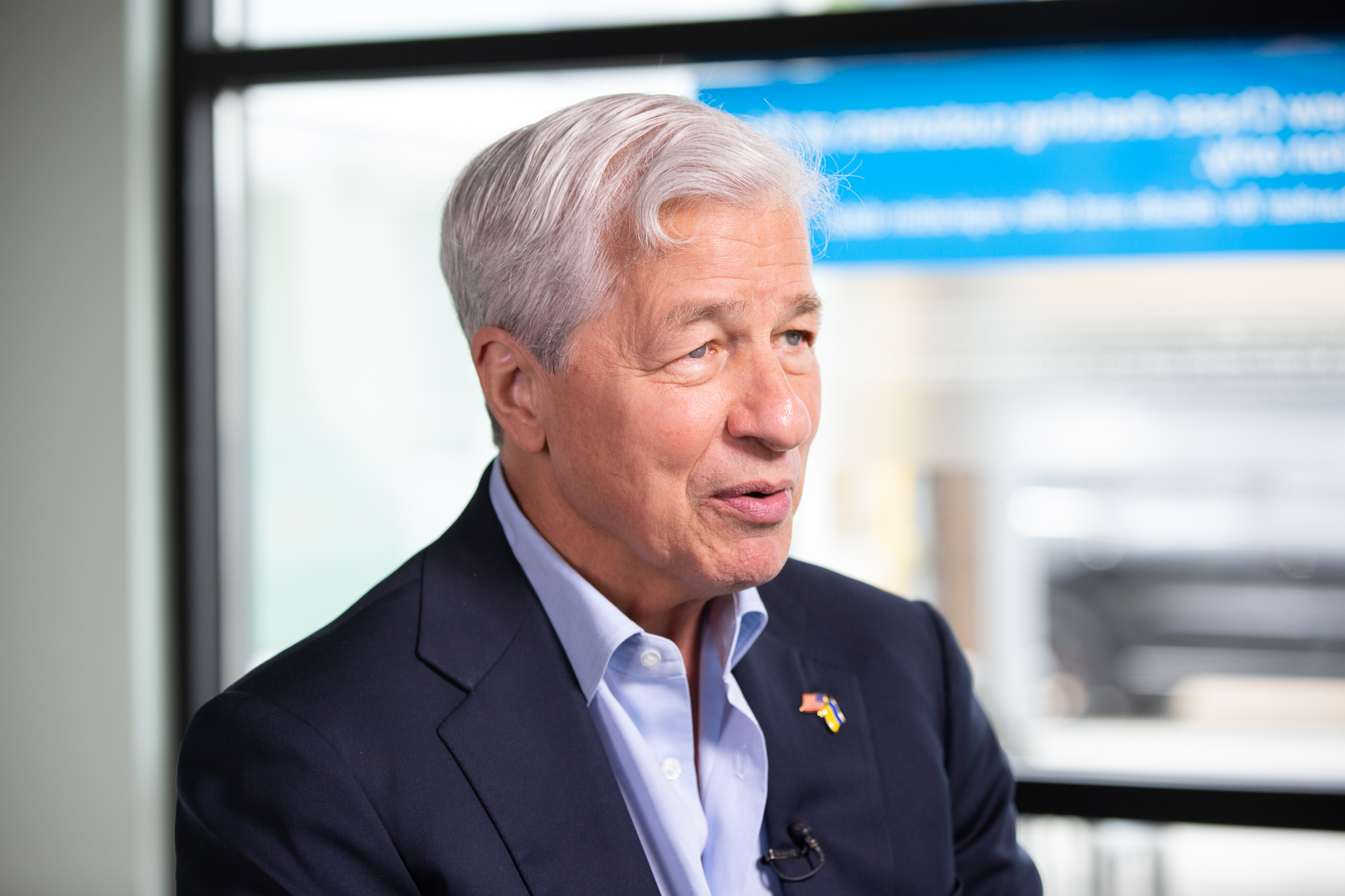

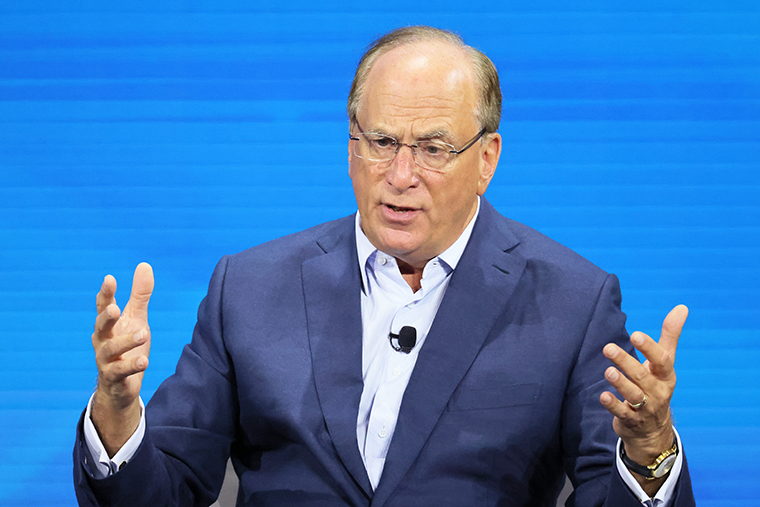

BlackRock, the world's largest asset management firm, slashed Chief Executive Officer Larry Fink's pay by 30% to $25.2 million for 2022, according to a filing with the Securities and Exchange Commission.

The move comes after the money manager reported first-quarter revenue that was down 10% from a year ago, as rising interest rates and economic uncertainty impacted the firm's bottom line.

"With respect to 2022 compensation, management determined to reduce the impact of the firm’s decline in profitability on BlackRock’s broader employee population by concentrating the downward adjustments to total incentive awards toward senior management," the filing said.

Total compensation for Fink, 70, included a base salary of $1.5 million and $23.7 million in total incentive awards. Several other executives saw their compensation reduced, including Rob Kapito, the firm's president, whose package shrank by 34% to $18.95 million.